- #NYS 529 ELIGIBLE EXPENSES 2015 SOFTWARE#

- #NYS 529 ELIGIBLE EXPENSES 2015 CODE#

- #NYS 529 ELIGIBLE EXPENSES 2015 PROFESSIONAL#

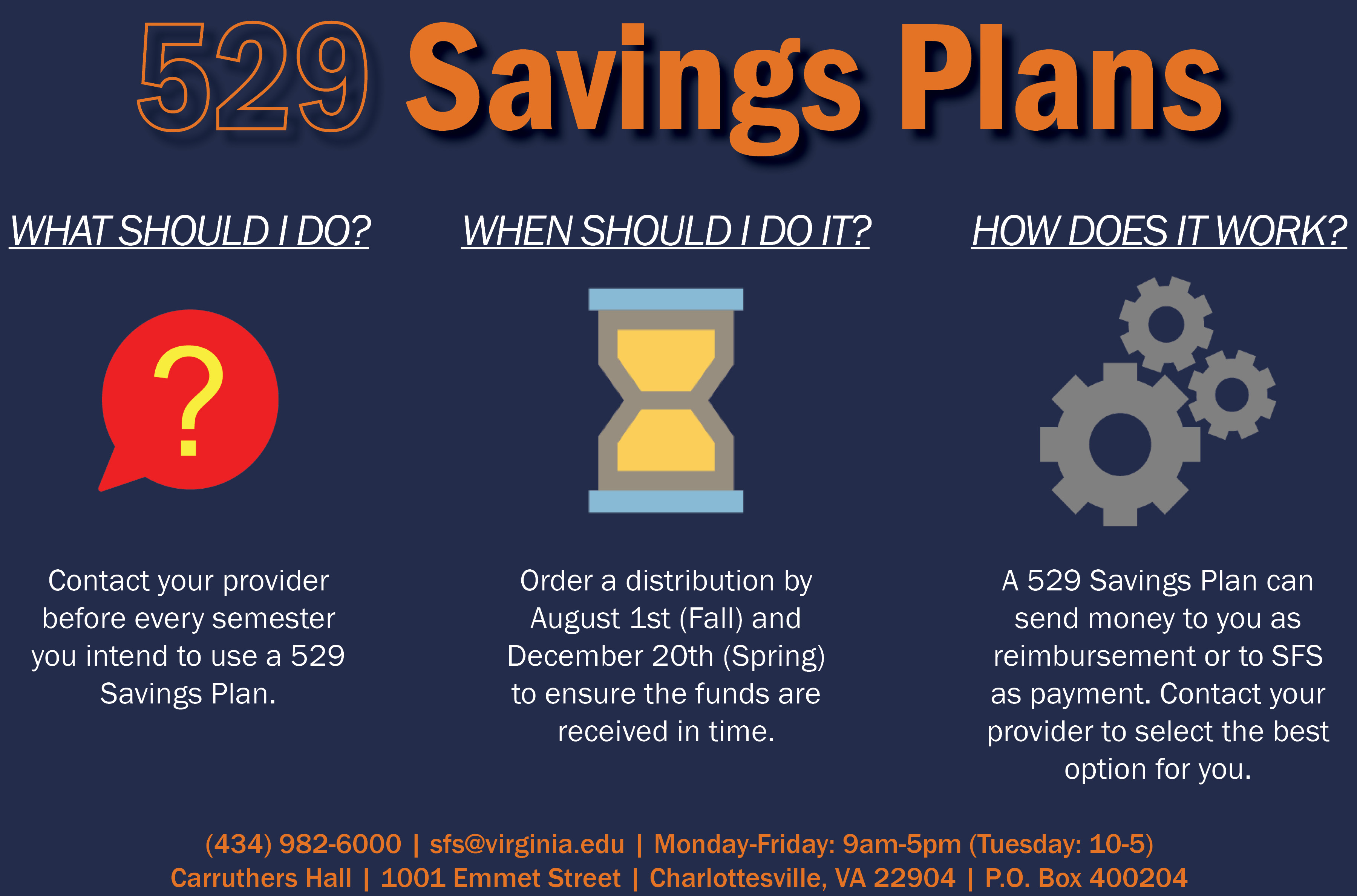

The parent can change the beneficiary to themselves and use the money to pay for their own graduate or professional school education. Sometimes, a child decides to not go to college. Also, depending on the account owner, a 529 plan for graduate school may count as an asset on the student’s undergraduate school financial aid application forms. The time horizon for graduate school differs from the time horizon for undergraduate school. It is better, however, for the family to set up a 529 plan just for graduate or professional school after the student has graduated from undergraduate school. Most often, a 529 plan is used to pay for graduate or professional school when there is leftover money from the beneficiary’s undergraduate education. When Do Families Use 529 Plans for Graduate or Professional School? Room and board, if the student is enrolled on at least a half-time basis.If it is more than the amount of New York State tax that you owe, you can claim a refund. The credit can be as much as 400 per student.

#NYS 529 ELIGIBLE EXPENSES 2015 SOFTWARE#

Expenses for the purchase of a computer (including peripheral equipment, software and internet access) The college tuition credit is a tax credit allowed for qualified college tuition expenses paid for an eligible student.Tuition and fees, books, supplies and equipment required for enrollment or attendance of the beneficiary at the graduate or professional school.The qualified higher education expenses include:

Qualified higher education expenses at a graduate or professional school are the same as at an undergraduate school.

#NYS 529 ELIGIBLE EXPENSES 2015 CODE#

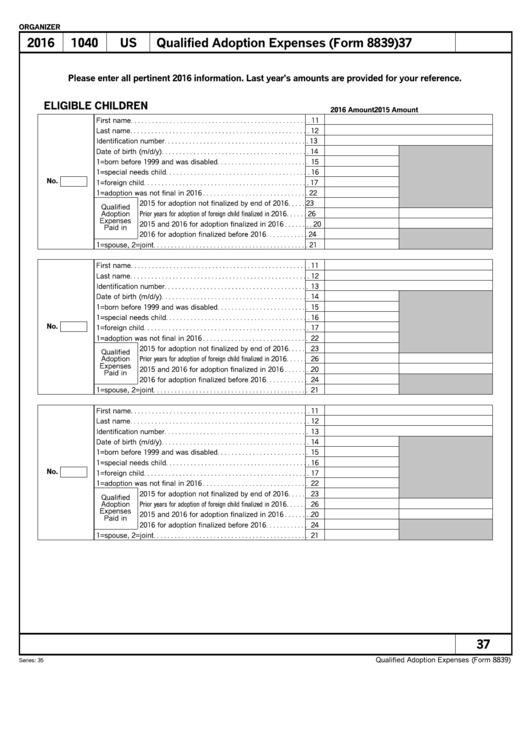

You can also use the Federal School Code Lookup tool on. For example, suppose your qualified education expenses are 10,000, you receive a 2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of 8,000 and earnings of 1,000. Note that graduate and professional schools often have a different Federal School Code than the undergraduate institution. Youll receive an IRS Form 1099-Q when you withdrawal money from a 529 plan or a Coverdell Education Savings Account. To determine whether a graduate or professional school is an eligible institution, look for the school’s Federal School Code on its web site. All graduate and professional degrees are eligible, including Master’s degrees (e.g., MSW, MBA, MA, and MS), doctoral degrees (e.g., PhD, and EdD), medical degrees (e.g., MD, DO, DVM and PharmD), and law degrees (e.g., JD and LLB). This publication explains that you can no longer claim any miscellaneous itemized deductions, unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses. This includes medical schools, law schools and business schools. This includes most graduate schools and professional schools in the U.S., as well as some foreign institutions. Which Graduate and Professional Schools Are Eligible?Įligible educational institutions include any college or university that is eligible for Title IV federal student aid. A distribution to pay for qualified higher education expenses at a graduate school or professional school will be considered a qualified distribution and therefore tax-free.

A 529 plan may be used to pay for the beneficiary’s graduate school or professional school education.

0 kommentar(er)

0 kommentar(er)